A solution For Your Microfinance Business

Solves Inadequacy, Simplifies Processes.

Proactively performs all financial documentations and transactions at a click, takes away stress and hassles of lengthy and confusing paper works.

Solving all Inadequacy,

With Accuracy and Security.

With guaranteed security for all marchants and thier users, Monates has been designed to solve all microfinance/cooperative organisation problems like:

- Record Keeping

- Inaccurate Profit

- Manual Calculations

- Mudding of loan disbursement

- Lost on track of long time loan

- Muddling of repayments and Timing

Monates Features

Monates have so many features in stock but here are some significant features, there is room for customization of these features to suit your company processes.

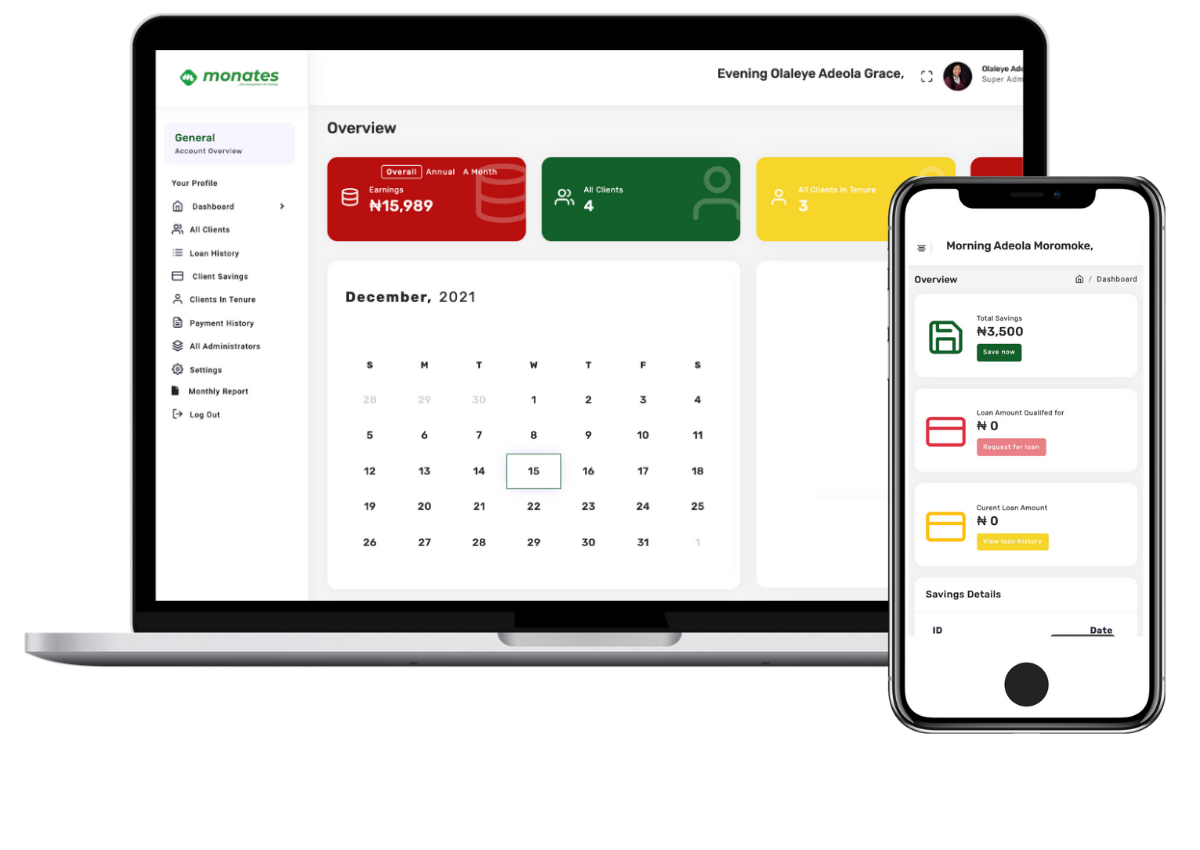

Admin/ Client Dashboard

The administrator dashboard includes the profit details, monthly, annually and overall, and overview of what is expected in the software, The Client dashboard consists of an overview of all details in the client's account.

Admin Privileges

This is referred to as an admin role, where you get to assign privileges to all staff that will be having an account as an administrator.

Client Account/Savings

At the admin end, there is client module where you get to add or upload clients, The clients also has the ability to create an account by themselves and own their own account, synchronized with their account at the administrator’s end.

Loan Analysis

The loan modules consist of all loan activities, both at the administrator end and at the client’s end, including Loan request, disbursement, repayment and date of repayment, total payback and loan history.

Payment History

For all payments made, including form payment, forward payment, loan repayment, and disbursement, there is a proper record of them all.

Automatic Calculations

For all calculations, including total payback, interest, monthly/weekly payback and so on, the system is designed to calculate them all appropriately.

Online Payment

There is an online payment feature, where the client saves directly from their bank account, and there is an option to deactivate all online payment.

Recurring repayment (Direct Debit)

This feature automatically charges clients due for loan repayment.

Automated SMS/ Email

For every transaction made, notification is sent as an email to the administrator, and also sms is sent to clients when their repayment date is near.

Testimonial

What Marchant Says About Monates

Uniquely provides adaptive quality software to automate all microfinance activities. Energistically iterate bricks-and-clicks web-readiness with accurate schemas,click the button below to drop your feedback

Let's Try! Get 100% Support

Start Your 6-weeks Free Trial

Monates Automates and Simplify your Processes

Quick Support

Get in Touch Today!

We are just a call away, we’ve designed our support system to be available and reachable at all times